When you make a gift you make it possible to

• Visit inspiring exhibitions that include more voices, variety and vitality

• Bring more people of all ages and all walks of life through the doors and on to the grounds

• Promote community well-being and connections

You can choose to support the Museum’s current operations and programs, explore an endowment opportunity or learn more about ways to include the Museum in your legacy plans.

Lyman Allyn Fund

Giving Now

Make an immediate difference by donating to our Lyman Allyn Fund.

Planned Giving

Giving Later

Planned gifts make a meaningful impact on the Museum’s present and future.

Lyman Allyn Park

Learn more about this project that will transform the Museum’s 12-acre greenspace into an urban community park.

Ways to Give

Gifts of all amounts – and in all forms – make a difference!

Make a one-time gift securely online using a credit card.

To make a gift by check:

- Print and complete this form

- Mail your check and completed form to:

Development Department

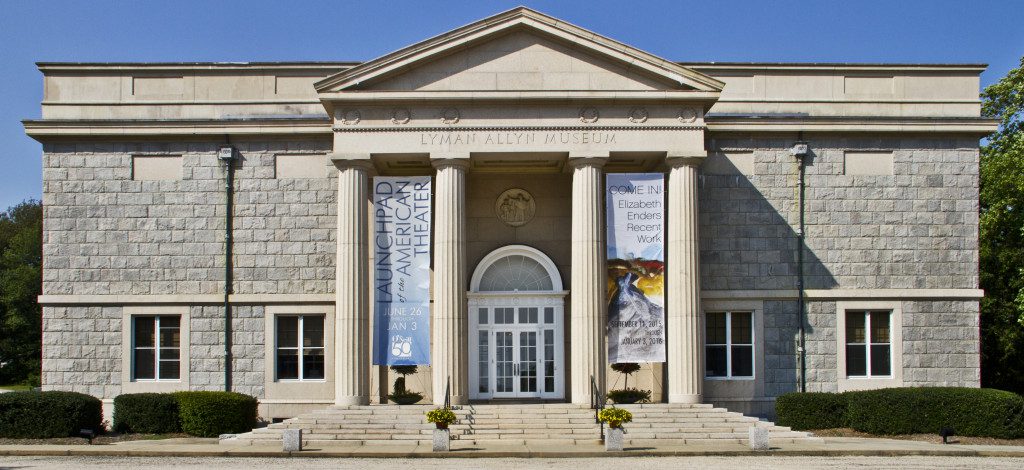

Lyman Allyn Art Museum

625 Williams Street

New London, CT 06320

Please call Mike Beasley, Director of Development, at 860.443.2545 ext. 2136.

Celebrate a loved one or mark a special occasion with an honor or memorial gift.

To begin this process, please click the link directly above or contact Mike Beasley.

Check for any matching gift opportunities from your employer or other organization.

If you have a donor advised fund or a family foundation, the Museum – as a 501(c)(3) public charity (EIN: 06-0646663) – is an eligible recipient for your advised or foundation grant.

To begin this process, please contact Mike Beasley.

Donating stock: consider the tax advantages of a gift of appreciated stock; you receive a tax deduction for the full fair market value of the stock on the date of transfer to the Museum; and you pay no capital gains tax.

To begin this process, please contact Mike Beasley.

The IRA Charitable Rollover (aka Qualified Charitable Distribution “QCD”) remains in effect for those age 70½ and older and it may be a wonderful opportunity for you to make a high impact gift. You can make direct transfers of up to $108,000 per year from individual retirement accounts to qualified charities without having to count the transfers as income for federal tax purposes. Gifts do not qualify for a charitable deduction but may be counted toward an individual’s required minimum distribution (RMD).

To begin this process, please contact Mike Beasley.

Gifts such as a Charitable Remainder Trust produce income for you during your life and become a legacy gift for the Lyman Allyn.

To begin this process, please contact Mike Beasley.

The permanent collection of the Lyman Allyn continues to grow through the generosity of individuals and organizations who donate works of art from their own collections. Donors also provide funding to purchase works for the permanent collection. The continued growth of the Museum’s holdings depends entirely on private support.

The Museum determines if an art gift will be accepted based upon the Lyman Allyn’s Collection Plan. If a work fits into the Museum’s collecting needs, the work can be accessioned following approval from the Board of Trustees.

To begin this process, please contact Mike Beasley.

Is Legacy Planning on your mind? As you consider a gift through your Will, a trust or by naming the Lyman Allyn as a beneficiary of a retirement plan, you can make a gift that costs you nothing in your lifetime.

To begin this process, please contact Mike Beasley.

Your company can support the Lyman Allyn and add a spark of art to the lives of your employees and to local residents of all ages! Click here to learn more about sponsorship levels.

This should not serve as tax or legal advice. Please consult your tax advisor on the advantages of these options.

You may also mail your gift to the Museum at the following address:

Lyman Allyn Art Museum, Development Department, 625 Williams Street, New London, CT 06320.

Questions?

To explore other opportunities to support the Lyman Allyn, please contact Mike Beasley, Director of Development, at [email protected].